The finance industry has transformed from physical to digital experiences, but that is no longer enough. As people get used to pervasive access to assets experiences must become seamless not merely connected.

From Digitally Connected to Seamless

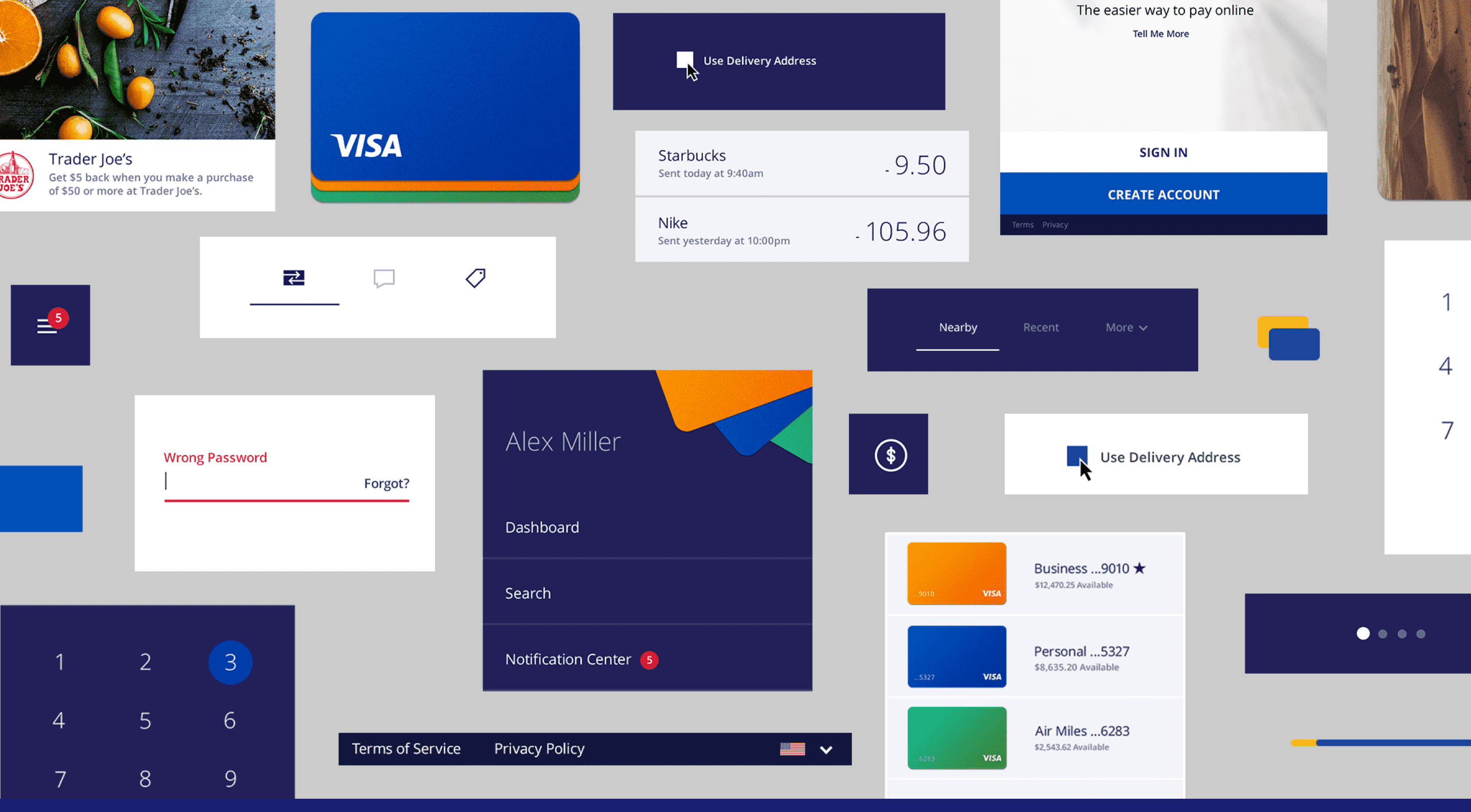

Everyday at Punchcut, we work with our financial clients to accelerate innovation and improve their customers’ experiences. In the process, we’ve identified five transformation points that will move companies beyond old paradigms to deliver more seamless, financial and payment experiences. Here are the first steps that should guide the path.

Step 1

Move Beyond Data - Put People First

In seamless services, data becomes invisible and intuitive insight will guide customers to value. Be relentless in creating clear, natural ways to deliver insight and demonstrate a trusted commitment to people.

Make People Feel Special

Everyone likes to feel special. By understanding a user’s financial status, spending patterns, investment risk profile, and financial literacy, companies have a huge opportunity to personalize their customers experiences and make them feel really valued.

“79% of consumers do not mind banks using data to offer improved products, services and advice.” - Financial Services Survey CGI

Earn Trust with Insight

Trust is the cornerstone of seamless financial experiences. Being transparent in every step of a user’s flow gains trust. Leveraging new technologies such as blockchain builds the kind of trust that leads to long-term relationships and loyalty. This allows for more accumulation of user data leading to a better, personalized experience.

Step 2

Move Beyond Money - Reframe the Service

Seamless services enrich relationships over transactions. Provide immersive experiences that holistically relate and empower customers across their lifestyle. Shape people’s lives, not only their money.

Support lifestyle over transactions

Pulling out a wallet to pay is being replaced by pulling out a phone. However, a truly seamless financial service will avoid the need for pulling out anything. Instead, the users themselves will authenticate purchases. In this way, people can naturally focus most on their highest level lifestyle needs without friction.

“If you are famous, you don’t have to tell anyone who you are. They will know you can pay and you should have immediate access.” - Payment Consumer

Offer Non-Traditional Services

In an era of lifestyle brands, companies are no longer staying in their box as non-traditional companies are providing payment services, home delivery services, and more. Financial service companies must consider new angles for services as brands will require broader offerings beyond their traditional focus to compete and meet customer’s needs in the future.

Step 3

Move Beyond Convention - Openly Innovate

Seamless services require collaboration and constant evolution. Evolve legacy processes and closed systems for sharing. Be open to learning from others and growing creative partnerships.

Innovate with design

Big financial service companies are now putting in a lot of effort to be at the forefront of innovation. Some have started internal innovation groups and some have even acquired design agencies. However, the key is to embrace design as a mindset, not simply an acquisition.

“87% of banks that have partnered with FinTech companies cut costs and 54% of partnerships increased revenue.” - Business Insider Report

Seamlessly Collaborate

To keep up with the rapid pace of innovation, collaborate and partner with others. Traditional financial institutions can leverage agile startups and move quickly without being bound by red tape. It could help increase customer engagement since people now are less loyal to financial institutions. Startups, on the other hand, can scale by leveraging traditional institutions’ long-built trust from the users.

Step 4

Move Beyond Intelligence - Augment Humans

Artificial intelligence opens up new opportunities for services and interactions. But all brains and no heart, risks a genuine connection. Humanize AI experiences to be personable and relatable. Augment intelligence with humans and augment humans with intelligence.

Augment with a Human Touch

While AI in the finance industry can bring many advantages, many users still want to interact with humans when it comes to discussing money. AI agents should be designed to feel friendly and human. Additionally, provide real human touch points to fulfill people’s needs around accountability, credibility, and emotional management.

“68% of investors prefer hybrid financial advisory services than human-only or robo-only advisory services.” - New Face of Wealth Management Accenture

Step 5

Move Beyond Complexity - Be Radically Simple

Seamless experiences must be simple for both consumers and providers. Yet, simple does not mean simplistic. Simplify interfaces to meet the essential needs of users in the most powerful way.

Simplify Radically

Pen and paper still take up a big portion of the workflow in the industry. Tools used internally or within the enterprise, such as those used by issuers and merchants are relatively outdated. Designing simple and focused enterprise experiences can improve efficiency and ultimately lead to a better customer experience.

“If [the navigation] were simpler and not so cluttered, then it wouldn’t take so long to look through the lists - I feel like it’s become a dumping ground for stuff.” - Internal Finance Services Employee

Moving to Seamless Financial Experiences

To be seamless, companies must embrace new paradigms driven by people-centric design. In our work with finance and payment companies, these five steps help us establish foundational principles that guide the design and innovation path to more seamless user experiences across financial products, internal tools, consumer research and future strategies for growth. While each step is simply stated, truly living its principle requires rigorous commitment, continued openness and transformative methods that inspire innovation.

A Punchcut Perspective

Eunsol Byun, Interaction Designer

Ken Olewiler, Principal & Managing Director

Contributors: Reggie Wirjadi, Emma Khater

© Punchcut LLC, All rights reserved.